SMS Alert when technical indicators cross thresholds

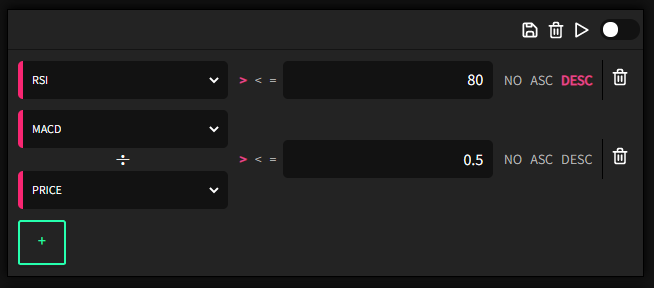

Technical indicators trigger very ambivalent responses - some swear that they work well (maybe even from their own experience), while others disagree heavily with the idea. Emotions in trading should be avoided at all cost - technical indicators can help in giving a clear framework which if followed rigorously may result in good returns (which to some can be attributed to the mechanical and non-emotional way of trading that results from that). We at alphalerts do not take a stance on that, but we do offer some tools for the first camp. For instance, one of the most popular combination of technical indicators is using the default Moving Average Convergence Divergence with the Relative Strength Index. With the platform, it is possible to receive alerts for any stock on which both MACD and RSI heavily agree on. For instance, check out the picture below. We look for a very large RSI at 80, which indicates an overbought stock, and additionally look for a rather large MACD at 0.5 (note that we divide MACD by the price, since the range of MACD depends on the price - this normalizes the MACD values and makes them comparable with other stocks).

It is now possible to generate SMS alerts based on stocks that actually cross these definitions. Any time NYSE is open, the platform periodically (every minute) checks whether the defined RSI and MACD thresholds are broken at the same time by any stock on the NYSE and NASDAQ. If that happens, you will be one of the first to know. You may then act upon that information, and hopefully generate good trades.