Stocks Options Queries

What are queries anyways?

Queries are like filters. They allow to filter out the few options from 1.2M options that you are interested in. Similarly with special KPIs (e.g. Equity Put/Call ratio) and stocks - find the stocks you are really interested in at the exact price you want to buy (or sell) at, even if that means waiting for an alert to pop up one day.

Maybe you are a proponent of the theta gang and you are simply looking for high theta options to sell some contracts and want to further analyze the top results. Or you want the lowest IV options and go long Puts or Calls on one of the results where you feel something huge might happen that the market is not seeing. There are a lot of strategies, and everyone has their favorite. You can use Queries to easier implement and research potential candidates for your own favorite strategy.

Here are a few examples for Queries (options) that you could do. There are currently four query types:

- Normal queries: Simply a key field such as IV or Theta and a threshold which is filtered against, i.e. if , the query finds a result. The inequality can be: >, ==, <.

- Division queries: Similar to normal ones, except that two fields are divided (e.g. ). The threshold is applied afterwards.

- Multiplication queries: Similar to division queries, except that two fields are multiplied instead of being divided.

- Subtraction queries: Also similar to division queries, except that two fields are subtracted from each other. This is good for spreads (IV spreads, bid-ask spreads).

For more on queries and how to create them, check out this page.

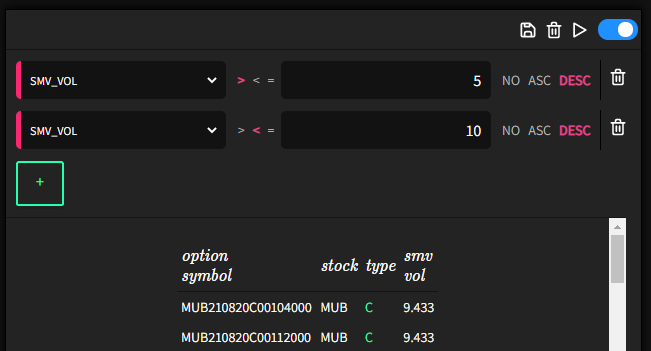

IV (=SMV_VOL) between 500% and 1000%

We look for high IV options that have between 500% and 1000% IV and sort descending such that the highest IV options are up top. As you can see, it is also possible to create range queries, i.e. queries with thresholds such that has to be between a range and .

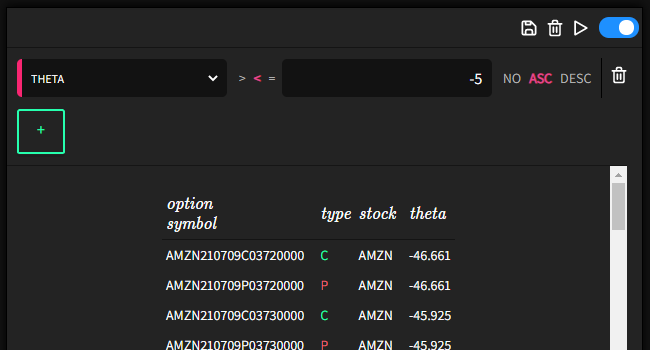

High Theta

We simply look for the highest negative theta we can find and sort ascending (since it is negative).

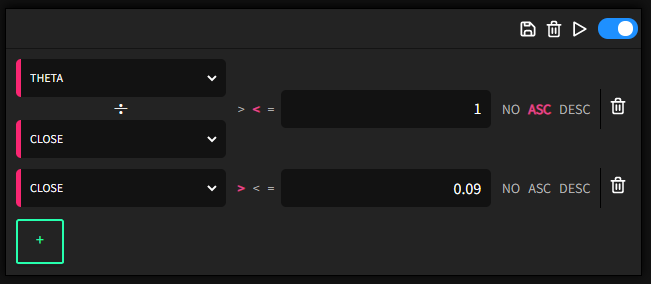

Theta / Close (division query)

We divide theta by close and make sure it's below -1. This normalizes theta a bit for large prices. Also we make sure that the option price (last close) is still at least 0.1$. We again sort ascending to get the highest negative value up top.

Next, there are a few examples for Queries for stocks that you could do.

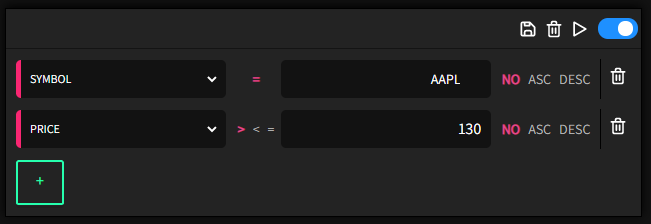

Price threshold for AAPL

We simply alert when AAPL breaks 130$.

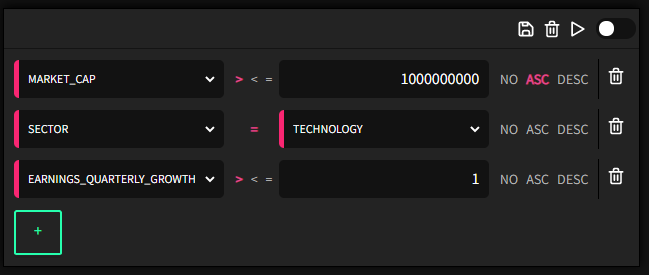

Micro-Cap Technology stocks with high EPS growth Q/Q

We look for micro-cap stocks (<100M market capitalization) in the technology sector that have an EPS growth Q/Q over 100%. Check out iSun for example, 550% EPS growth Q/Q.. Interesting. One could also query for small-cap stocks.. Lots of possibilities.

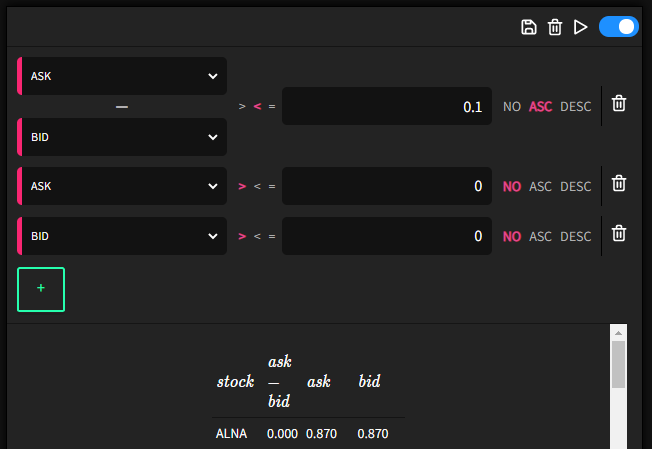

Tightest Bid/Ask Spreads

We simply look for stocks with the tightest bid/ask spread we can find. Surprisingly, we even find some negative ones. That does not mean anything though - likely there was a sell-off happening and this was just a momentary occurrence.

Limits

To keep the system running well, currently you can run 20 queries per minute from the online platform, so one query every 3 seconds. We think this is a very fair limit even for advanced users, that is likely never reached. Still, if you need more, be sure to contact us.